Crypto fear index falls to 10 as Strait of Hormuz tensions rise

20 February 2026

Impact of Geopolitical Tensions on Cryptocurrency Markets

The cryptocurrency market has experienced fluctuations in sentiment and market performance, heavily influenced by geopolitical developments. This week, the crypto fear index saw a decline from 12 to 10, amidst rising tensions in the Middle East. Iran, a key player in the region, conducted military exercises that led to the temporary closure of the Strait of Hormuz. This strategic passage is pivotal for global oil transport, serving as a conduit for a substantial portion of the world's crude oil supply. Disruptions in this area have far-reaching consequences, including increased energy costs which can have a detrimental impact on Bitcoin mining operations.

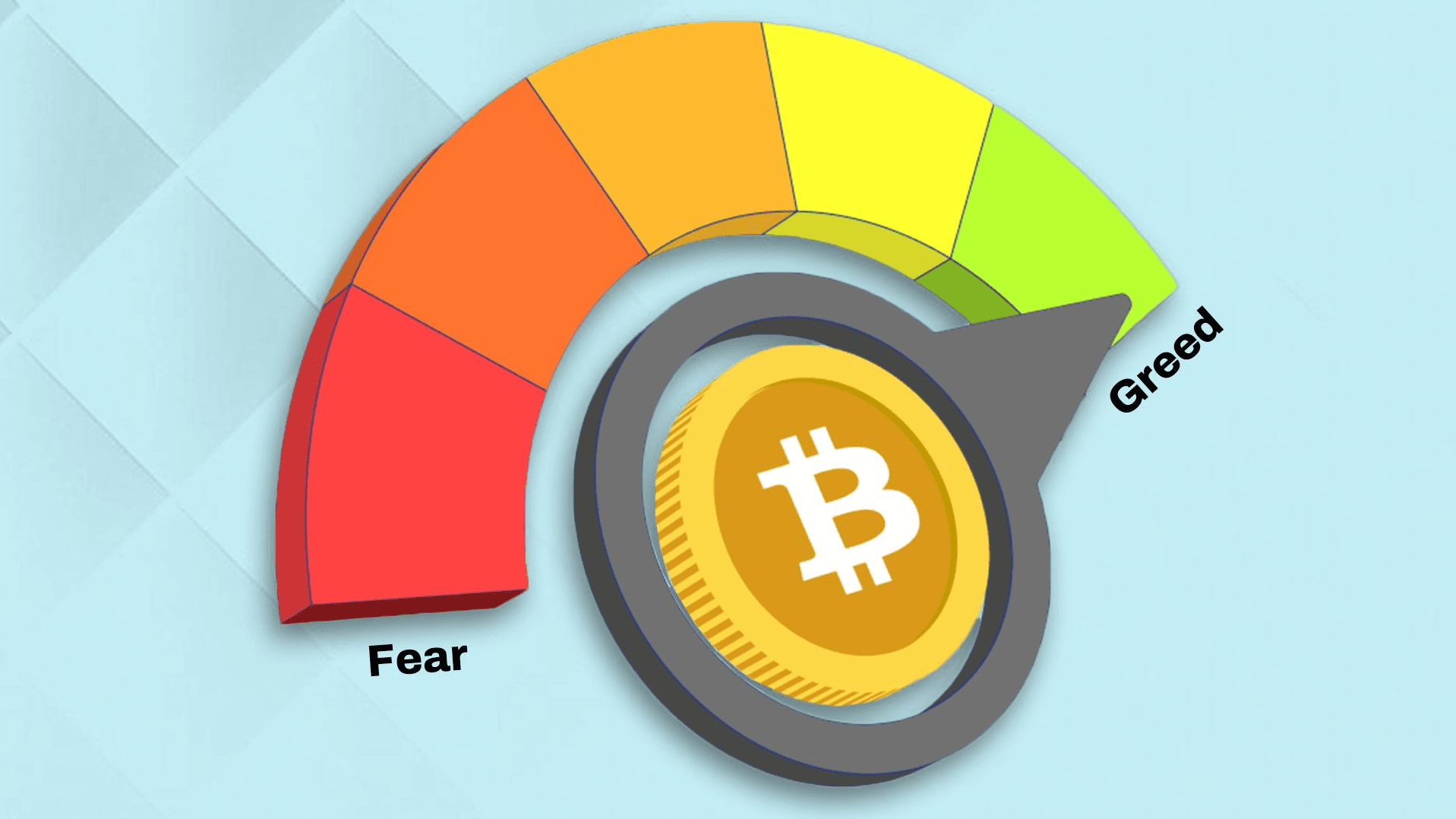

Understanding the Crypto Fear and Greed Index

The Crypto Fear and Greed Index is a barometer of market sentiment, gauging the emotions and attitudes of market participants toward cryptocurrency investments. A drop from 12 to 10 indicates increasing fear, which often leads to conservative market behavior. Traders become risk-averse, reducing their exposure to volatile assets like cryptocurrencies. This shift is attributed to geopolitical instability, reminding investors of the interconnectedness of global events and digital asset markets.

The Strait of Hormuz: A Vital Economic Vein

The Strait of Hormuz is not only a geographical choke point but an economic lifeline for energy markets worldwide. With 31 percent of ocean-transported crude oil passing through, any interruptions have the potential to ripple across the global economy. This week’s military drills by Iran exemplify how geopolitical maneuvers can elevate global energy prices and, subsequently, the operational costs for industries reliant on affordable energy, such as Bitcoin mining.

Increased Energy Costs and Cryptocurrency Operations

Bitcoin mining is an energy-intensive process, requiring significant electricity consumption to validate transactions and secure the cryptocurrency network. As energy prices soar due to geopolitical upheavals, miners may find their profit margins eroded. This could compel them to either downscale their operations or liquidate held cryptocurrencies to offset expenses, producing downward pressure on market valuations and overall liquidity.

Negotiations and Market Uncertainty

While the military exercises advance, Iran and the U.S. engaged diplomatically in Geneva, highlighting the delicate balance between military posturing and peaceful negotiations. The outcome of these talks is vital; a breakdown could exacerbate tensions, whereas successful diplomacy might alleviate market fears, potentially restoring market stability. Analysts keenly watch these developments, acknowledging their potential to set the tone for regional and global market trends.

Macro-Economic Factors and Cryptocurrency Sentiment

The current landscape sees cryptocurrency markets heavily influenced by macro-scale economic factors. As risk-on assets, cryptocurrencies are sensitive to global events and economic health indicators. This week, market participants awaited critical U.S. economic data, particularly from the Federal Reserve, to guide their trading strategies. Data releases such as durable goods orders and the PCE price index serve as indicators of economic performance and inflation trends, helping traders to anticipate shifts in Federal Reserve policies and adjust their positions accordingly.

The Interconnection of Geopolitical Events and Market Dynamics

The developments this week underscore the interwoven nature of geopolitical events and financial market dynamics. Investors and traders in the cryptocurrency space must remain astute, leveraging a comprehensive understanding of both international relations and economic indicators to navigate the complex landscape. Recognizing the multifaceted influences on market sentiment can provide a strategic edge, reinforcing the importance of staying informed and adaptable in a rapidly evolving global economy.

Go to all articles

Read more

16 February 2026

Binance removed from Google Play Store Philippines | Inquirer Technology

13 February 2026

Danske Bank Adds Bitcoin, ETH ETPs, But Warns Of 'High Risk'

09 February 2026

The Anticipated Altcoin Airdrop May Be Coming Soon - They Have Officially Applied in the US

06 February 2026

Coinbase Faces Legal Headwinds and Stock Decline Amid Market Pressure

04 February 2026

South Korea Deploys AI to Hunt Crypto Market Manipulation

02 February 2026

Digital Assets Crater as Precious Metals Rout Triggers Broader Market Contagion

26 January 2026

UK inflation rises to 3.4% in December, led by tobacco and travel costs

21 January 2026

Audi F1 team sign new sponsorship deal with Gillette and Nexo

19 January 2026

BlackRock scooped up over $1 billion of these cryptocurrencies in a week

12 January 2026

Samson Mow tips Elon Musk will 'go hard' into Bitcoin in 2026

07 January 2026

ALGO Price Prediction: Targeting $0.16-$0.19 by February 2026 as Technical Indicators Signal Bullish Momentum

05 January 2026

Coinbase Charts a Course Beyond Cryptocurrency Trading

Do you need a customized plan for trading?

Effective assistance on various aspects of your trading account and other financial activities related to trading on the broker's platform.